Recognizing the Scarcity Mindset

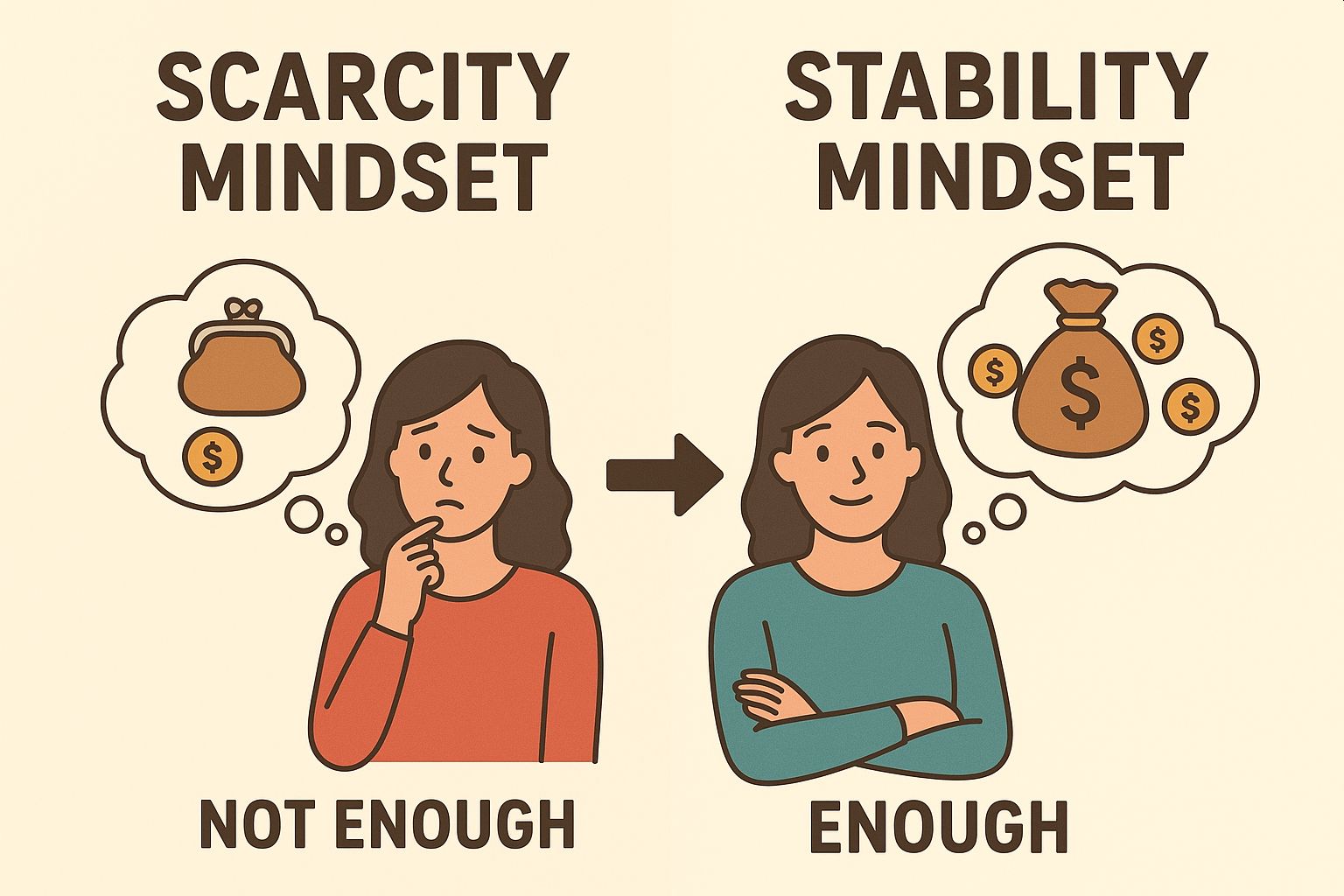

Many people live in a quiet state of tension, shaped by a deep fear of not having enough. Whether it’s money, time, or opportunity, scarcity thinking can color every decision. It keeps you focused on what’s missing instead of what’s possible. This scarcity mindset can make even small challenges feel overwhelming because it operates from the assumption that resources are limited and success is fleeting.

The scarcity mindset doesn’t just affect finances—it influences relationships, career choices, and personal growth. It can lead to hoarding, overworking, or even avoiding risks that might lead to progress. But with awareness and consistent effort, that fear-driven way of thinking can shift toward stability, where your choices come from confidence and clarity rather than panic. If your financial stress feels constant, exploring options for debt relief can be one step toward reducing that sense of urgency and creating a foundation for long-term peace of mind.

Understanding What Stability Really Means

Stability doesn’t mean having endless wealth or perfect circumstances. It’s a mindset rooted in trust—trust that you can handle challenges, adapt to change, and make thoughtful decisions. It’s the calm that comes from knowing you’re building toward something sustainable, even if you haven’t reached it yet.

True stability is less about the size of your bank account and more about your ability to manage it with balance and purpose. It’s about developing habits that create security over time: saving regularly, spending intentionally, and maintaining emotional steadiness around financial ups and downs.

A study by the American Psychological Association highlights how chronic financial stress can cloud decision-making, leading people to prioritize short-term relief over long-term stability. Shifting out of scarcity means breaking that pattern by building awareness and focusing on sustainable actions that restore control and reduce anxiety.

Reframing How You See Resources

When your mindset is anchored in scarcity, every dollar or opportunity feels like it’s slipping away. Shifting toward a stability mindset requires a reframing of how you view resources. Instead of focusing on limits, start by noticing the opportunities within your control. That might mean finding small ways to save, creating side income, or simply re-evaluating how you allocate your time and attention.

The key is to view money as a tool rather than a measure of self-worth. If your income fluctuates, stability can come from building flexibility into your budget rather than striving for impossible predictability. Even simple actions—like automating savings or paying down debt—help signal to your brain that progress is happening.

This shift in perspective can extend beyond finances. When you believe you already have enough to take the next step, creativity opens up. You become more strategic, patient, and confident in how you pursue your goals.

Building Daily Habits That Foster Stability

Creating stability starts with small, consistent habits that build over time. The goal is not to eliminate all uncertainty but to create enough structure that you can handle it better when it comes.

Here are some practical ways to move from a scarcity mindset to a stability mindset:

- Track your spending and income: Awareness is the foundation of control.

- Set realistic short-term goals: Focus on what you can achieve in the next month, not just the next year.

- Practice gratitude: Recognizing what you already have helps quiet the internal narrative of lack.

- Simplify your financial routine: Automatic bill payments or savings deposits reduce decision fatigue.

- Educate yourself: Learning about budgeting, investing, or credit management builds confidence and autonomy.

A sense of stability grows with consistency. You don’t need to change everything at once—just enough to prove to yourself that progress is possible. Over time, these habits become a safety net that supports emotional and financial resilience.

Reconnecting with Purpose and Gratitude

Scarcity thrives when life feels directionless or disconnected from meaning. Stability, on the other hand, grows when you align your actions with purpose. When your financial choices reflect what matters most—family, health, personal growth—they become more fulfilling and less stressful.

Practicing gratitude is one of the simplest and most effective ways to strengthen this mindset shift. Studies from the Greater Good Science Center at UC Berkeley show that gratitude improves well-being and reduces stress by reframing how people perceive challenges. Focusing on what’s working in your life doesn’t ignore problems—it gives you the mental clarity to face them from a place of balance.

You can start with small rituals like writing down three things you’re thankful for each day or acknowledging positive changes in your routine. Over time, gratitude helps you recognize progress as it happens instead of waiting for perfection.

Addressing Fear and Financial Anxiety

Moving from scarcity to stability also involves addressing the emotional side of financial insecurity. Fear-based decision-making can lead to cycles of avoidance, impulsive spending, or burnout from overworking. The first step in breaking that cycle is acknowledging it.

When financial stress feels overwhelming, talking with a counselor, trusted advisor, or financial coach can help put things into perspective. It’s not just about budgeting—it’s about understanding your relationship with money and finding healthier ways to manage it.

It’s also important to separate your self-worth from your financial status. Stability grows when you stop defining yourself by what you lack and start valuing how you respond to challenges.

Trusting the Process of Growth

The transition from scarcity to stability doesn’t happen in a straight line. Some days will feel like you’re making progress; others might bring setbacks or unexpected expenses. What matters most is persistence and self-trust.

Every time you make a thoughtful decision, save instead of spend impulsively, or confront a fear instead of avoiding it, you’re strengthening your foundation. With time, that foundation becomes a source of stability that extends beyond money—it influences how you approach work, relationships, and life in general.

Finding Peace in ‘Enough’

The scarcity mindset tells us we’ll only feel secure once we have more. Stability comes from realizing that “enough” is not a limitation—it’s freedom. When you recognize that your worth is not measured by your possessions or status, you create space for calm, gratitude, and confidence.

Shifting from scarcity mindset to stability mindset isn’t about ignoring challenges or pretending life is always abundant. It’s about trusting that you have the ability to build and sustain what you need. It’s about recognizing that progress happens gradually—and that, in itself, is enough to move forward with strength and peace.